tax benefit rule definition and examples

99514 1812a2 substituted reducing tax imposed by this chapter for reducing income subject to tax or reducing tax imposed by this chapter as the case may be. Examples of this include educational assistance programs which are tax free up to 5250 in the 2019 tax year and transportation benefits which are.

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

Tax Benefit means a reduction in the Tax liability of a taxpayer or of the affiliated group of which it is a member for any taxable period.

. In the example above Company XYZ could. Gross income does not. Tax benefit rule n.

However defined benefit plans are often more. Personal use is any use of the vehicle other than use in your trade or business. However in 2012 the taxpayer receives a state tax.

Your tax benefit is the difference between the 12600 deduction you would have claimed without the state tax deduction versus the 13000 you actually claimed. A tax benefit is an allowable deduction on a tax return intended to reduce a taxpayers burden while typically supporting certain types of commercial activity. Example of the Tax Benefit Rule.

The tax benefit rule ensures that if a taxpayer takes a deduction attributable to a specific event and the amount is recovered in a subsequent year income tax consequences of the later event depend in some degree on the prior related tax treatment. For 2022 the standard mileage rate is 585 cents per mile. The tax benefit rule states that if a deduction is taken in a prior year and the underlying amount is recovered in a subsequent period then the underlying amount must be included in gross income in the subsequent period.

For example if a taxpayer recovers an expense or loss that he previously wrote off against the prior years income then the recovered amount must be included in the current years gross. A rule that if one receives a tax benefit from an item in a prior year because of a deduction such as for an uninsured casualty loss or a bad debt write-off and then recovers the money in a subsequent yearthe money must be counted as income in the subsequent year. It is usually based on a representative or administrative data set and certain policy rules.

Other example is a claim against the taxpayer such as a local property tax or an employees salary which is deducted when paid. A tax-benefit model is a form of microsimulation model. Tye The Tax Benefit Doctrine Reexamined 3.

These models are used to cost certain policy reforms and to determine the winners and losers of reform. 98369 amended section generally substituting provisions relating to recovery of tax benefit items for provisions relating to recovery of bad. Examples of tax benefit.

Tax benefit rule definition April 25. If you receive. The tax benefit rule is frequently overlooked yet in just a few minutes it can save taxpayers money.

Jones recovers a 1000 loss that he had. A taxable benefit is a benefit that a taxpayer receives typically paid for by a corporation that is more related to personal choices than business expenses. For example in 2008 the head of Cirque du Soleil took a trip to the International Space.

A tax benefit allows. One example is EUROMOD which models taxes and benefits for 28 EU states. The tax benefit rule is codified in 26 USC.

The tax benefit rule means that if a taxpayer receives a tax benefit from an item in a prior year because of a deduction and then recovers the money in a subsequent year the money must be treated as taxable income. A theory of income tax fairness that says people should pay taxes based on the benefits they receive from the. Plumb The Tax Benefit Rule Tomorrow 57 HARV.

Note however that the tax benefit rule does not prevent companies from taking advantage of changing tax rates it doesnt protect them either. The tax benefit rule is intended to ensure that companies do not write off debt with the intention of collecting it later and not paying taxes on it. A tax rule requiring that if an amount as of a loss used as a deduction in a prior taxable year is recovered in a later year it must be included in the gross income for the later year to the extent of the original deduction NOTE.

Of the 1000 refund you receive from Iowa 400 of it will be taxable on your 2017 federal return. Payroll taxes used to finance social security may also reflect a link between benefits and contributions but this link is commonly weak because contributions do not go into accounts held. Benefits Received Rule.

Read more for the full break-down and benefits. If the amount of the loss was not taken as a deduction in the year the loss occurred the. Defined benefit plans provide a fixed pre-established benefit for employees at retirement.

The tax benefit is the lessor of the actual deduction claimed or the amount the deduction causes your total itemized deductions to exceed your applicable Standard Deduction amount. A taxpayer itemized in 2011 and deducted state income taxes paid in 2011. Tax Benefit Rule 55 TAXES 321 1977.

Employees often value the fixed benefit provided by this type of plan. In the above example the taxpayers AGI was reduced by 24323 resulting in a tax savings of at least 480 and possibly as high as 1200 if deductible medical expenses are affected. If the amount of the loss was not taken as a deduction in the year the.

You can use the cents-per-mile rule if either of the following requirements is met. If this is the case then the taxable benefit is counted as income to the person who receives it. Plumb The Tax Benefit Rule Today 57 HARV.

The benefit principle is utilized most successfully in the financing of roads and highways through levies on motor fuels and road-user fees tolls. This amount must be included in the employees wages or reimbursed by the employee. Except as otherwise provided in this Agreement a Tax Benefit shall be deemed to have been realized or received from a Tax Item in a taxable period only if.

That results in a 400 difference which is your tax benefit. Legal Definition of tax benefit rule. On the employer side businesses can generally contribute and therefore deduct more each year than in defined contribution plans.

A tax rule requiring that if an amount as of a loss used as a deduction in a prior taxable year is recovered in a later year it must be included in the gross income for the later year to the extent of the original deduction. Significant tax savings can be obtained by understanding recognizing and applying the tax benefit rule.

Tax Deductions Lower Taxes And Tax Liability Higher Refund

What Are Marriage Penalties And Bonuses Tax Policy Center

Advantages And Disadvantages Of Trial Balance Trial Balance Accounting Basics Accounting Principles

Employee Consent Letter Excellent Letter Of Consent Also Contains Resources With Information On Consent Letter Letter Writing Samples Consent Letter Format

Comma Rules 8 Rules For Using Commas Correctly Eslbuzz Learning English Essay Writing Skills Comma Rules Learn English Grammar

Tax Advantages For Donor Advised Funds Nptrust

Tax Deduction Definition Taxedu Tax Foundation

/ScreenShot2021-02-12at3.32.18PM-40b79df9059346d4aaef488825e16a46.png)

Schedule A Form 1040 Or 1040 Sr Itemized Deductions Definition

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

How The Tcja Tax Law Affects Your Personal Finances

What To Do When You Owe Back Taxes Infographic Business Tax Deductions Business Tax Tax Help

Tax Rules For Claiming Adult Dependents

How Does The Deduction For State And Local Taxes Work Tax Policy Center

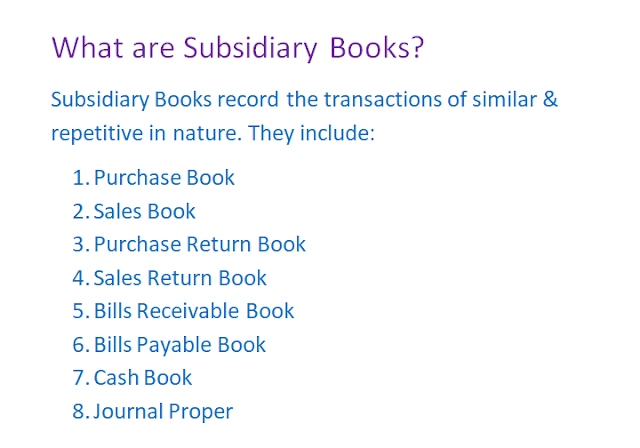

What Are Subsidiary Books And Its Types Profit And Loss Statement Cash Flow Statement Book Meaning

Annuity Exclusion Ratio What It Is And How It Works

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

What Is The Purpose Of Preparing Subsidiary Book Book Meaning Profit And Loss Statement Cash Flow Statement

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center